My first title to this post was "We're Being Quantitatively Eased and We Don't Even Know It", which seemed wordy and nebulous. You guys know how I like to, tongue in cheek, try to come up with some kind of sensationalist headline tying back to tango. Just for fun. For this one the tie-back is much more difficult - obviously it doesn't make sense.

I tried to think of a relationship between printing more money and tango. $600,000,000,000 aka six hundred billion dollars are being printed up (the first $105 billion this coming week) over the next eight months. I'm not completely clear on the whole thing, but they are saying "We're not printing money", and are emphasizing that they are buying government bonds.

So a guy spends a lot of money on his tango, but nothing happens...?

As in the "All hat and no cattle" concept?

So a guy spends a lot of money on his tango, his ego gets inflated (inflation), and his tango gets weaker (deflation)...?

So a guy spends a lot of money on his tango, learns some half-assed kickass highboleo moves, leading to ego inflation, and destabilization of the milonga...?

So a guy spends a lot of money on his tango, leading to ego inflation, and takes a trip to Buenos Aires aka TangoMecca for further lessons and a world stage to show off his half-assed kickass highboleo moves, which leads to destabilization of an international milonga, and finds that the women aren't impressed by his ego nor his tango, which leads to ego deflation, and tango stagnation...?

So a guy spends a lot of money on his tango, leading to ego inflation, decides to manifest himself into a tango a teacher and teach his HAKAHB to others, (begins to troll the milongas across the globe for a suitable potranca rusa/SYT/teaching partner), leading them to invest more of their hard-earned short-supplied greenbacks into their tango, which in turn leads to further tango deflation and destabilization of the milongas, resulting in dissatisfied women, who stay home to watch "Dances with the Stars", yielding a gender imbalance, stimulating the lamentations of the menfolk to yield even higher investment into tango investment bonds, which of course, the guy benefits from as a direct result...? (Guy and SYT move to Spain or Isla de Pantelleria to open a Tango bar using the windfall tango profits and live happily ever after)

Or, finally, in desperation, confusion and frustration, the guy decides to just give his tango greenbacks to the tango dealers (in "support", without actually attending any classes), and hopes that somehow it will get infused back into his tango, somehow, someday, somewhere...?

Probably not.

Who knows? I don't completely understand it - on the downstream end anyway - in terms of how this will benefit the global economy, or not. Methinks someone, somewhere, somehow, some day soon, will be stuffing their pockets and teabags with at least some of the aforementioned $600 billion.

My gut tells me we are in for a wild ride over the next 30 years aka "the rest of my life". Maybe by then I will be a highly leveraged milonguero wannabe/blacksmith.

Stay tuned for my upcoming articles - "The Qualitative Easement Tango" and "Tango Derivatives Demystified"!

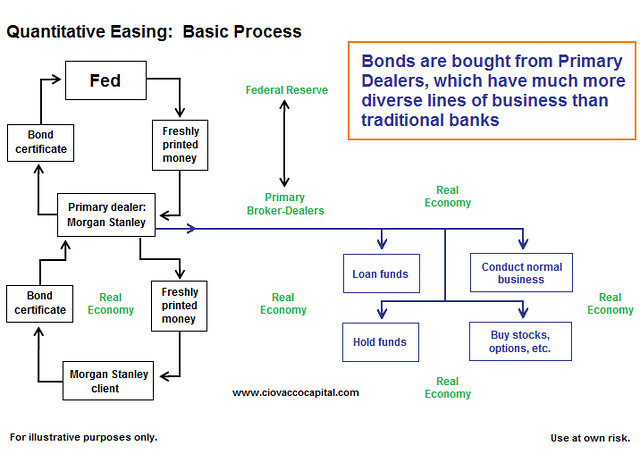

Here is the first (1 in 5) article in a series explaining QE2 - that appears to be pretty good, albeit technical/economicspeak, with a flowchart and all. Cool!

"Common sense tells us money printing is probably not the path to long-term prosperity and low unemployment, but common sense also tells us after a possible QE disappointment pullback, newly printed U.S. dollars will be finding their way into the global stock, commodity, and currency markets. The big questions are (a) how much QE is coming in terms of a dollar amount, and (b) how much of that money will find its way into the financial markets."

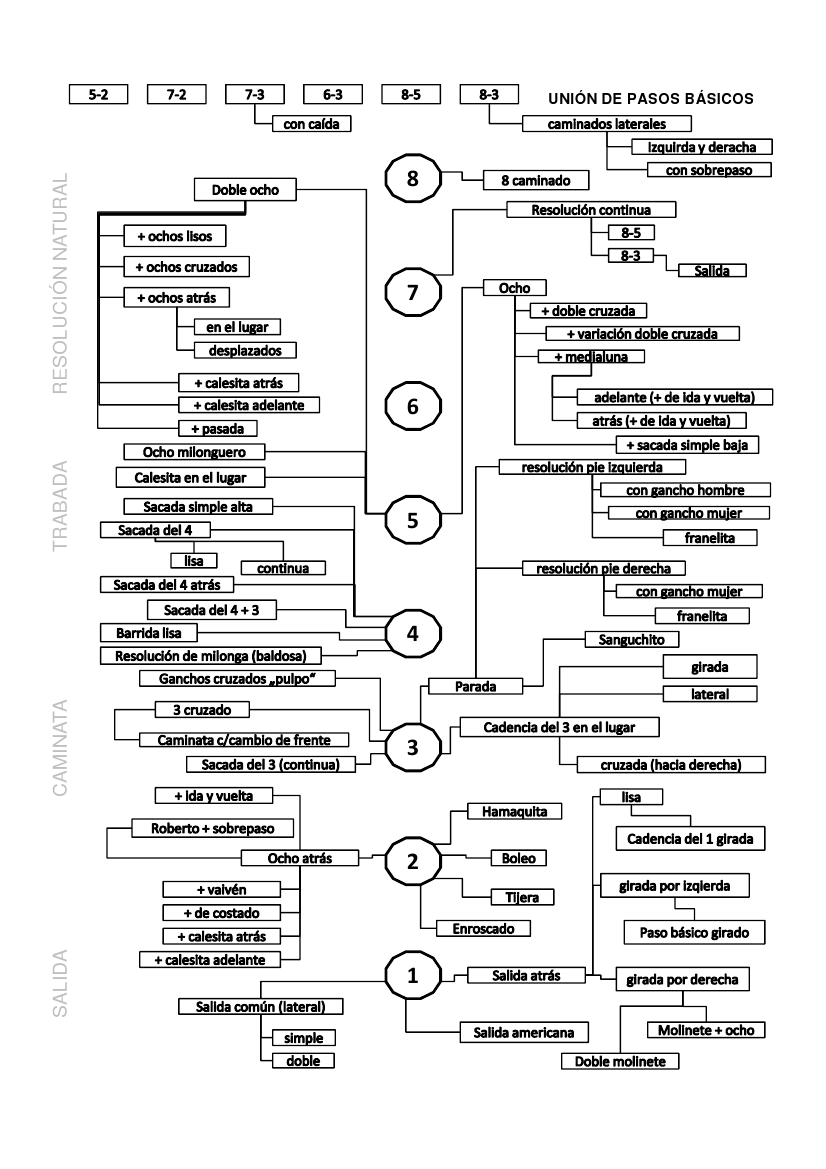

And here is the corresponding Quantitative Easement for Tango flow chart:

You *know* they always say that Tango is THE most complicated investment a human being can make. This is why monkeys don't dance tango or make investments or try to influence the global economy to the upside.

Here's a tiny blurb I found on the topic on MSNBC: (although I didn't look very hard)

By JEANNINE AVERSA

The Associated Press

updated 11/10/2010 3:24:54 PM ET 2010-11-10T20:24:54

WASHINGTON — The Federal Reserve says it will buy a total of $105 billion worth of government bonds starting later this week as it launches a new program to invigorate the economy.

The bonds will be purchased through a series of 18 operations that start on Friday and end on Dec. 9. The purchases are the first since the Fed announced last week that it will buy a total of $600 billion worth of Treasury bonds over the next eight months.

The Fed will buy $75 billion of government debt as part of the new program. And, it will buy another $30 billion, using the proceeds from its vast mortgage portfolio.

That totals $105 billion for the first phase of the Fed's government bond buying. The Fed last week said it anticipates buying on average $110 billion a month.

And finally, the genesis for this post, from Dieudonne's comment on my Jon Stewart post...thanks D!

Actually, having written/blogarreah'd this self-amusing piece of BS, I have arrived at that tie-back (there is a word for this) that I was looking for - the true essence of the quantitative easement of global tango - in the vein of too much of a good thing. But I'm out of time. I have to get to work now.

And coffee...I need my coffee.

2 comments:

did you make the video too? that was scary and hilarious rolled into one!

No...not me. Perhaps I'll be an economist in another life.

Post a Comment