Sorry folks, but no, this is not my post about how much my tango has cost me over the past seven years. Or is it eight? I dunno. Some day I may get around to writing that post. It would be an interesting one, especially when you factor in lost opportunity costs and loss of profit. I get this nagging retro rearview don't want to look at it was it all a dream feeling that my tango came at great cost to me. HUGE investment. The return on that investment? Hmm. You'll have to stay tuned whilst I ponder and cipher on that one. And I'm not talking about greenbacks. Well, maybe kindasorta that too. Whatever. But I digress. (grin)

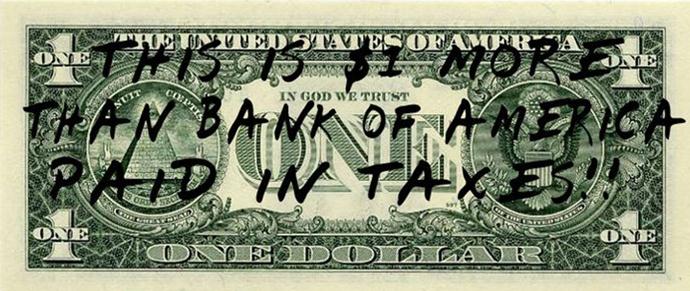

This one is about Warren Buffet's op-ed in the New York Times about the super-wealthy getting preferential treatment by Congress and not paying enough taxes. I haven't actually read it yet, but I wanted to post it before I get too far down the road and forget.

Here's the link: http://www.nytimes.com/2011/08/15/opinion/stop-coddling-the-super-rich.html

And then there's this little tidbit from Warren - thanks to La Reina for sending it to me:

The Federal Budget put in simpler terms...

The U.S. Congress sets a federal budget every year in the trillions of dollars. Few people know how much money that is, so we created a breakdown of federal spending in simple terms. Let's put the 2011 federal budget into perspective:

• U.S. income: $2,170,000,000,000

• Federal budget: $3,820,000,000,000

• New debt: $ 1,650,000,000,000

• National debt: $14,271,000,000,000

• Recent budget cut: $ 38,500,000,000 (about 1 percent of the budget)

It helps to think about these numbers in terms that we can relate to. Therefore, let's remove eight zeros from these numbers and pretend this is the household budget for the fictitious Jones family.

• Total annual income for the Jones family: $21,700

• Amount of money the Jones family spent: $38,200

• Amount of new debt added to the credit card: $16,500

• Outstanding balance on the credit card: $142,710

• Amount cut from the budget: $385