"The problem is so large, it threatens fiscal destabilization..." I am paraphrasing remarks by Allen Greenspan on the credit crises. Yes, crises, not crisis. Plural. Multiple crises. Not a singular crisis. Personal credit, corporate/business credit, government credit, national debt. Understand that credit is synonymous with debt.

The past couple of days, I have been feeling a very palpable feeling of impending doom and dread. It's something I have never felt before, and I don't like it. It's not a good feeling. But, I trust my gut. I trust my connection to the universe to tell me when something is amiss. Maybe this is it? Maybe not.

Now, I am by no means an economist, but I am most definitely cursed by a very lucid big picture point of view. Big picture and long term.

I'm not sure where to begin with all this.

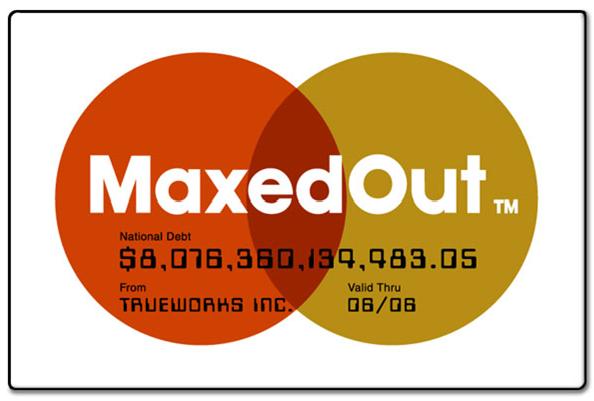

I will start with what prompted this post. I just finished watching "Maxed Out" - a documentary by James Spurlock. Here is the link to the film's website.

Here is the YouTube Trailer:

Here is the info from the YouTube site :

Americans are buying with plastic at a staggering rate. From lattes to vacation packages, car payments to home-equity loans, our reliance on credit is increasing. Even the Internal Revenue Service endorses credit cards as a "convenient" way to pay your taxes. The average American family carried about $9,300 in credit-card debt in 2005 reports the nonprofit Consumer Credit Counseling Service in Dallas. But what happens when borrowers who already have sizable debts are offered more credit?

Director James Scurlock, 34, set out to tackle that question in "Maxed Out," a documentary he intended as a comic portrayal of consumer irresponsibility. What the self-described "finance geek" and former publisher of a financial newsletter ended up with however, is a much starker tale—one of struggle, suicide and desperation. "I think the people in the film would like nothing more than to pay off their bills, but they've just gotten to a point where it's not possible," says Scurlock. "And at some point, they're just being preyed on [by lenders] and manipulated and squeezed so hard that they can't ever hope to recover. And that's not right."

Here are the highlights I can recall from my first viewing:

::

Sharecropping replaced slavery - we all know this. We all know that sharecropping was a system of credit/debt. What probably did not dawn on many of us is that it was a system that immediately and in large part permanently ensared those living under the illusion of "freedom". I would offer that slavery - or being trapped by debt - has expanded to include a wide variety of social groups across all races. It is present and prevalent across the globe today.

::

The Federal Debt is at $9 trillion plus and is growing by roughly $1,000,000 per minute. We can barely keep up with the interest payments. Is part of the reason that our infrastructure is suffering (highways, bridges, airports, water systems, sewage systems, and on and on); we cannot afford to pay our soldiers more than a pittance; we cannot care for our soldiers with good hospitals; we cannot care for the many uninsured; we cannot keep our parklands maintained and open to the public; we cannot pay our teachers good salaries, nor educate our children; we cannot respond to natural disasters (Katrina); we cannot help those devastated by Katrina almost three years later - is the reason, in large part, because most of the funds are going to service the national debt? The film alludes to the growing problem of shrinking federal funding in many critical areas due to funds being diverted to interest payments on the federcal deficit.

::

Experian, TransUnion and the other one...the credit "agencies" keep a separate database on VIP's - "important" people - judges, congressmen, actors (unbelievable), ceo's - in order to ensure a higher level of accuracy in their credit reports. A 100% correct credit report in fact. For the rest of us, they depend on, actually want, need our credit histories to be inaccurate and fraught with errors.

The film states that these "important" people could easily cause trouble in the mdedia for the credit agencies - so it is in their best interest to devote special resources to ensure 100% accuracy for these folks.

::

Your income level has nothing to do with your FICO credit score.

::

Suze Orman, the TV financial guru, is supported by credit card companies.

::

MNBA, the nation's second largest credit card issuer, was the top campaign contributor to George W. Bush's last presidential campaign.

::

Since Bush's (pushed by the banking/credit card industry/lobby) bankruptcy reform act, suicide (or death by natural causes), is becoming the only option for many people to relieve themselves of their debt.

::

The current "average" family with 2.3 kids actually has less money available to make ends meet and cover the basics of food, shelter, health care, and transportation than the same family, same obligations, did back in 1970.

::

College students are especially targeted by banks/credit card issuers - each year a whole new crop of 18 year olds emerge - fresh fodder for the credit/debt industry. Not technical college students, not high school graduates with jobs, but newly enrolled college students.

Worse, the banks/credit card companies PAY the colleges and universities large sums of money to be allowed to solicit college kids. Yes, they are just kids.

::

A pawn shop proprietor is interviewed in the film. It's an interesting peek into a different segment of the population. He says that the pawn shop "is" the bank for these folks. They don't have credit cards or bank accounts. The pawn shop is their financier.

::

Harvard Law School Professor Elizabeth Warren wonders about what the exit strategy is for this problem. She asks "really smart" people in the government - and said that she just got stupid grins and no response.

This same woman was invited to speak at a gathering of banking executives - credit card issuers. She said that by screening the riskiest of consumers - and denying them credit - that the banks would see a 50% decrease in the number of defaults. After discussing the facts and figures and evidence for some time, one man in the back of the room raised his hand. He said that if the banks were to screen out these "high risk" consumers, that the banks would see their profits fall dramatically. Profits from interest, late fees, and other fees. Basically, banks make a very large percentage of their profits on the least sophisticated customers - the ones with the least ability to assume and repay debt.

This is a serious, serious problem. To me, it's like a huge asteroid about to hit the Earth. Among the multitudes of environmental, social, political, economic and energy problems that humanity faces today, I think this one could be responsible for the undoing of it all. The one to bring down the house of cards we westerners have built over the last 100 years.

Populations rise and fall with the tides of nature and the passage of time. Civilizations rise. Civilizations fall.

I don't know what to do about it. Can anything be done about it?

I don't know what to think about it. I don't know what more to write about it.

I know I don't understand it.

I know that rising gas prices, energy problems, ongoing military actions in Iraq & Afghanistan, the subprime/mortgage/credit crisis (what we see right now) are just the tip of the iceberg for what lies ahead.

I'm thinking now that I should have kept my subscription to "The Mother Earth News".

Watch the film. Rent it. Neflix it. Buy it. Watch it.

1 comment:

Being a history major, i can tell you the credit system goes back hundreds of years. It's gotten exponentially bigger of course but the cost to the creditee is the same - enslaved to almost a lifetime of debt. Suze Ozman may be supported by credit card companies but I learned a few things about budgeting from her.Actually managed to shave off a few hundred dollars a month in bills thanks to her. As a single mother, that's much appreciated!

As a birthday gift to each of my sons, i am getting them consultations with financial advisors on their 18th birthdays. I've always thought it so strange that parents don't talk to their kids about money and finance. Isn't that part of getting them ready for adulthood? My parents always assumed that I would be married and supported by my husband when I grew up. As a result, I got myself into credit card debt when my university was handing them out like candy. Took me years to get out of credit card debt. Nevermore.

Post a Comment